A General information

1. Explanatory information on the consolidated financial statements

The consolidated financial statements of the Volksbanken Raiffeisenbanken Cooperative Financial Network prepared by the Bundesverband der Deutschen Volksbanken und Raiffeisenbanken (BVR) [National Association of German Cooperative Banks] are based on the significant financial reporting principles set out in the annex. The cooperative shares and share capital of the local cooperative banks are held by their members. The local cooperative banks own the share capital of the central institution either directly or through intermediate holding companies. The Cooperative Financial Network does not qualify as a corporate group as defined by the International Financial Reporting Standards (IFRS), the German Commercial Code (HGB) or the German Stock Corporation Act (AktG).

These consolidated financial statements have been prepared for informational purposes and to present the business development and performance of the Cooperative Financial Network, which is treated as a single economic entity in terms of its risks and strategies. In addition, the financial statements have been prepared in compliance with the provisions set out in article 113(7)(e) of Regulation (EU) No. 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No. 648/2012 (Capital Requirements Regulation – CRR). These consolidated financial statements are not a substitute for analysis of the consolidated entities' financial statements.

The underlying data presented in these consolidated financial statements is provided by the separate and consolidated financial statements of the entities in the Cooperative Financial Network and also includes data from supplementary surveys of the local cooperative banks. The consolidated financial statements of DZ BANK included in these consolidated financial statements have been prepared on the basis of IFRS as adopted by the European Union.

The financial year corresponds to the calendar year. The consolidated companies prepare their financial statements as at the reporting date of December 31, 2021. With 18 exceptions (2020: 20 exceptions), the separate financial statements of the entities accounted for using the equity method are prepared using the same balance sheet date as that of the consolidated financial statements.

In the interest of clarity, some items on the face of the income statement and the balance sheet have been aggregated and are explained by additional disclosures.

Information as regards the significant financial reporting principles can be found in the annex to the consolidated financial statements.

2. Scope of consolidation

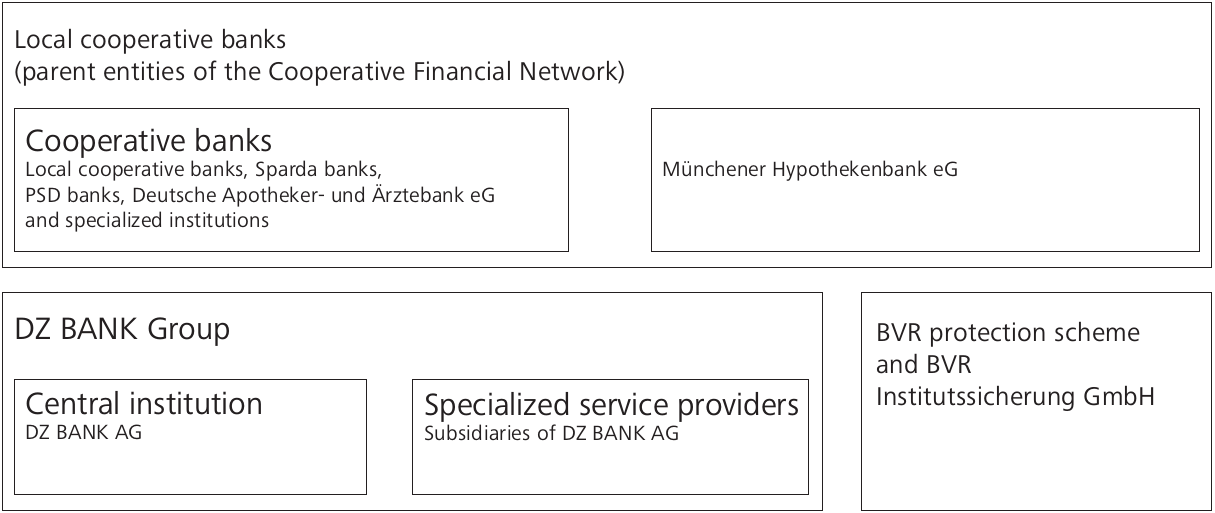

The consolidated financial statements comprise, as consolidated entities, 771 primary banks (2020: 814) as well as all companies included in the consolidated financial statements of DZ BANK, Münchener Hypothekenbank eG (MHB), the BVR protection scheme, and BVR Institutssicherung GmbH. The consolidated cooperative banks include Deutsche Apotheker- und Ärztebank eG, the Sparda banks, the PSD banks, and specialized institutions such as BAG Bankaktiengesellschaft.

Volksbanken Raiffeisenbanken Cooperative Financial Network

The cooperative banks and MHB are the legally independent, horizontally structured parent entities of the Cooperative Financial Network, whereas the other companies and the DZ BANK Group are consolidated as subsidiaries. The cooperative central institution and a total of 151 subsidiaries (2020: 183) have been consolidated in the DZ BANK Group. In the year under review, the scope of consolidation of the DZ BANK Group changed primarily due to the disposal of the companies established by the DZ BANK Group for the purpose of increasing own funds in accordance with Section 10a of the German Banking Act (Kreditwesengesetz – KWG).

The consolidated financial statements include 5 joint ventures between a consolidated entity and at least one other non-network entity (2020: 6) and 24 associates (2020: 25) over which a consolidated entity has significant influence, that are accounted for using the equity method.